Despite the cryptocurrency market's staggering $3 trillion market capitalization in 2021, now at $1.04 trillion, traditional financial markets still struggle to tap into the potential of digital assets. This leaves traders, investors, and crypto enthusiasts unable to make the most of their assets "time value." Unlocking this value allows individuals with idle assets to earn interest and gain liquidity without selling their holdings, avoiding missed potential gains. While centralized exchanges like Binance, Bittrex, and Kraken have attempted to address these needs with lending and borrowing, they come with trust-based systems, exposing users to security risks and lacking actual ownership of assets, keeping all transactions virtual and off-chain. For example, the recent events of Genesis and FTX show that some centralized systems lack the ethos of crypto and are vulnerable because of uncollateralized debts and human errors.

Due to the events above, decentralized lending protocols have proven to be the antidote to these issues and exist on every prominent Layer 1 blockchain. Hatom, the first decentralized lending protocol on MultiversX, is an example of such, as it provides tools and resources that create a rich environment of trust, liquidity, incentives, and governance within the MultiversX DeFi landscape. Hatom and other decentralized protocols are critical to the DeFi infrastructure and bring a lot of efficiency within Layer 1 networks, as they provide liquidity and depth to markets while improving network security and efficiency.

This project review will delve into Hatom’s founding team, tokenomics, business model, and protocol. The review will conclude by highlighting the strengths and potential challenges of the project.

What is Hatom - Protocol, Interface, and Launch

Hatom operates as a peer-to-pool protocol within the MultiversX blockchain ecosystem. In this framework, liquidity is provided by lenders who contribute tokens to a shared pool of assets, while borrowers access this liquidity by obtaining tokens from the same pool. Both lenders and borrowers engage with these communal pools, which are managed by smart contracts. Hatom adjusts interest rates, ensuring lenders receive competitive returns and borrowers pay rates reflecting current demand and supply within the ecosystem. Each pool is an exclusive money market for the ESDT token.

The team has gone through various testing phases and released different modules of the protocol; through this, Hatom has been able to build a user-friendly platform with robust security measures. The team prioritizes user convenience and security, allowing users to access lending, borrowing, and staking services through their connected wallets. They also put education at the forefront, making sure users understand the provided features; these include:

- Lending App

- Liquid Staking

- Isolated Pools

- USH Staking

- Universal Lending

Through these products, Hatom can address the limitations faced by centralized exchanges. For example, through liquid staking Hatom, the limitations of self-staking and exchange staking are addressed, as it allows users to stake any amount of compatible tokens and maintain liquidity by receiving tokenized representations of their staked funds. Lido, for example, is a platform offering this functionality for Ethereum and has been shown as a viable alternative for users. Liquid Staking solutions also align with the broader concept of DeFi, where decentralization and accessibility are offered along with staking rewards.

The MultiversX blockchain processes 15,000 transactions per second (TPS) for $0.001 per transaction. This renders MultiversX an appealing network to corporate entities and decentralized finance initiatives, such as Hatom. Furthermore, as the first liquidity protocol within the MultiversX ecosystem, Hatom contributes to the expansion of DeFi development on the network and is a compelling example to external projects, illustrating the untapped potential for further growth and innovation. In fact, Hatom currently has a 67% share of the TVL within the entire MultiversX ecosystem.

Since the official launch of Hatom in July 2023, the team has reached significant milestones, underscoring its rapid growth and strong adoption:

- $100 Million TVL: In less than a week, the project surpassed $100 million TVL within the first week of the launch.

- Over 1.47 Million EGLD Staked in Liquid Staking: The MultiversX liquid staking module attracted substantial engagement, with over 1.47 million EGLD staked across 31 validators. This demonstrates the community's keen interest in participating in the platform's staking offerings.

- Over 10,200 Active Users: Hatom has two separate modules integrated in a single protocol. Right now there are 5,870 users active on the lending protocol and 4,386 active users on the liquid staking module.

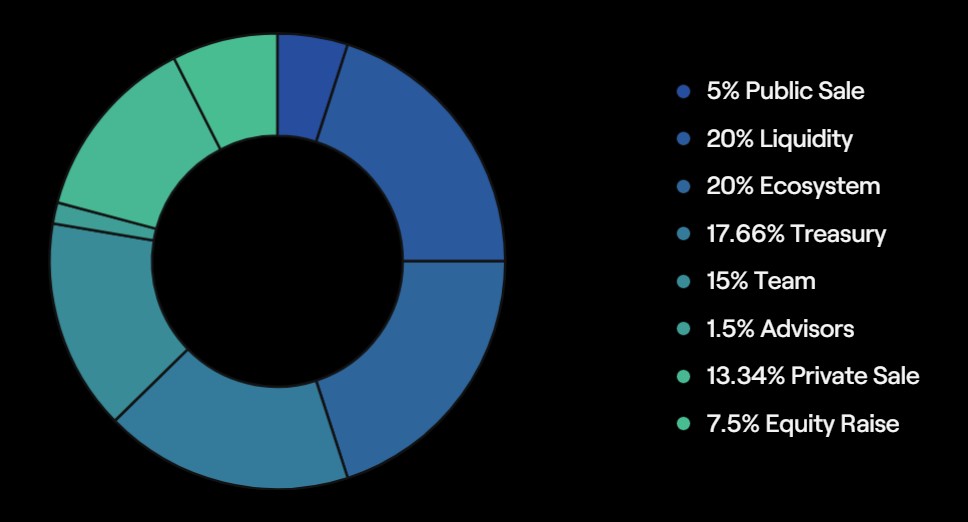

Tokenomics and Governance

The Hatom token ($HTM) is positioned at the core of the emerging DeFi ecosystem, with the Hatom protocol serving as the standard lending protocol within the MultiversX Blockchain. The community holds the power to determine the course of innovation, listing policies, and various enhancements that aim to position the lending platform as a frontrunner in the industry.

Token holders drive new initiatives, features, or service upgrades that are decided via community polls. To participate in these polls and exercise their voting rights, a specific quantity of Hatom Tokens is required. The Hatom Protocol's team continually collects and monitors data, facilitating ongoing improvements and the selection of polls that align with community expectations and desired enhancements.

To provide immediate utility, the Booster and Accumulator features will be launched in the upcoming weeks. This will allow users to stake their HTM tokens in a dedicated staking module within the lending protocol. Additionally, they will be able to increase their net APY based on the percentage of HTM tokens staked compared to their collateral value; a 5% relationship between HTM tokens and collateral will enable users to receive a full boost of their position.

Furthermore, once the token will become less volatile and its liquidity will increase, HTM token will have its own dedicated money market where users can supply it and use it as collateral to get over-collateralized loans.

Once the protocol will get more mature and the phase to bootstrap liquidity will be over, the staking module will be released, where users will be able to deposit their HTM token and receive a source of real yield; Hatom will use a part of its protocol revenue to buy back HTM tokens from the open market and reward the stakers. Ultimately, Hatom's governance and utility features, underpinned by the Hatom Token, aim to enable a dynamic and community-powered ecosystem well-positioned for sustained growth and innovation.

Founding Team, Partnerships, and Seed Funding

Founding Team, Partnerships, and Seed Funding

Hatom was founded by CEO Ahmed Serghini, Oussa Guennouni, and Soufiane Mouatassim Billah who together established a team of 24 professionals to grow the protocol. Working closely with the MultiversX ecosystem, the project attracted many others from the space and raised around $2M in a public sale round from several crypto institutional investors, and $4M in a prive sale round.

Analysis - Strengths and Challenges

Strengths:

- Educational Focus: Hatom is committed to educating the public on DeFi and lending protocols, making it easier for users to understand complex technologies. This approach can reduce entry barriers for newcomers and promote widespread adoption.

- High-Speed Infrastructure: Hatom offers users a seamless and efficient experience by leveraging the MultiversX Blockchain's high bandwidth, low latency, and fast transaction speeds through sharding. This infrastructure aligns with the demands of millennial users who seek instant service.

- Secure Lending Platform: Hatom ensures its lending platform is secured by continuously monitoring, auditing, and claiming to be the "most secure lending platform available on the market." For example, the claims are backed by 10 audits and 2 penetration tests done by some of the biggest firms in the crypto space such as Certik, Halborn, PeckShield, Hacken, RunTime Verification and Arda. This feature is reassuring to users concerned about the safety of their assets.

- Future Expansion of Services: Hatom's roadmap includes launching a treasury program, allowing users to deposit fiat cash and receive interest without the complexity of dealing with cryptocurrencies. Additionally, introducing pegged tokens like Ethereum, Bitcoin, and DAI adds versatility to the platform.

Challenges:

- Regulatory Uncertainty: The DeFi space operates in a gray area, and navigating potential regulatory challenges can be complex. Hatom must stay updated on evolving regulations and ensure compliance to mitigate legal risks.

- Staking Yield Sustainability: The sustainability of the staking yield model, where a percentage of lending network earnings is shared among stakers, may depend on the platform's overall growth and profitability. Ensuring attractive rewards while maintaining financial stability will be a challenge.

Future Roadmap:

In the near future, Hatom has plans to introduce the Accumulator and Booster modules. These modules will empower users to enhance their yield earned through the lending protocol. Users can boost their earnings by staking HTM tokens equivalent to 5% of their collateral position, adding a new layer of flexibility and profitability to the platform. After the launch, Hatom plans to launch the first native over-collateralized stablecoin on MultiversX ( USH ). The team believes this has an immense potential to increase the liquidity across MultiversX and offer users a safe, native, decentralized and over-collateralized stablecoin without being exposed to bridge risks or centralization.

Additionally, Hatom is set to pioneer the MultiversX community's adoption of the first automated leveraged liquid staking strategy, xEGLD. This approach aims to significantly increase staking Annual Percentage Yield (APY) by leveraging liquid staking tokens.

These upcoming developments demonstrate Hatom's commitment to evolving the DeFi space and offering new avenues for users to maximize their earnings and engage in the MultiversX ecosystem.Learn more about Hatom ⬇️

🌐 Official website: https://hatom.com/

📡 Official Global Telegram Community: https://t.me/HatomProtocol

🐦 Official Twitter: https://twitter.com/HatomProtocol

📜 Medium: https://blog.hatom.com/

🕹️ Discord channel: https://discord.com/invite/WekwfUDXGp

Related Project Reviews

Portal to Bitcoin - Custodyless Cross-chain Infrastructure Built for Bitcoin

In this month’s review, we explore Portal, a custodyless cross-chain infrastructure built for Bitcoin, its innovative BitScaler and PortalOS solutions, the recent Aurelia Testnet launch, and how it enhances Bitcoin’s scalability and utility for DeFi applications.

1

Dec 11, 2024